Stamp Duty Refund – Your Complete Guide to Claiming Back £15,000-£50,000 in 2025

Thousands of homebuyers can claim back stamp duty each year without realising they qualify for a refund. The additional property surcharge alone can add an extra five percent to your bill money you might reclaim if you know the rules.

This HMRC stamp duty refund guide walks you through everything needed to understand how to claim back stamp duty, determine your eligibility, and successfully reclaim what you’re owed. Whether you’ve recently completed on a property purchase or bought years ago, understanding these rules could put thousands of pounds back in your pocket.

Understanding Stamp Duty Land Tax and Why You Can Claim Back

Stamp Duty Land Tax (SDLT) represents a government charge levied when purchasing property in England and Northern Ireland. The amount varies based on property value, buyer status, and whether you own additional properties.

Standard residential rates apply to single property owners, starting at zero percent for properties under £250,000 and increasing in bands as values rise. First-time buyers benefit from relief up to £425,000, paying nothing on this threshold.

The complication and opportunity to claim back stamp duty arises from the additional dwelling surcharge, also known as HRAD (Higher Rates for Additional Dwellings). Anyone owning multiple residential properties pays an extra five percent on top of standard rates from the effective date of purchase. This includes second homes, buy-to-let investments, and situations where you temporarily own two properties during a house move.

Parliament introduced this surcharge to discourage property portfolios and help first-time buyers compete. However, lawmakers recognised legitimate scenarios where temporary dual ownership occurs through no fault of the buyer. HMRC stamp duty refund provisions exist specifically for these situations.

Many buyers pay the surcharge assuming they’ll never see that money again. They’re wrong. Government statistics show millions in unclaimed refunds sit waiting for buyers who simply don’t know they can reclaim stamp duty. The process demands attention to deadlines and paperwork, but the financial reward often justifies the effort.

Key Timeline Changes:

- April 2016 – October 2024: 3% additional dwelling surcharge

- October 31, 2024 onwards: 5% additional dwelling surcharge (current rate)

Who Qualifies to Claim Back Stamp Duty? Refund Eligibility Guide

Eligibility centres primarily on replacing your main residence within specific timeframes. The most common scenario involves buying a new home before selling your previous one a situation countless buyers face when chains move slowly or when securing your next property takes priority over perfect timing.

Main Residence Replacement: How to Claim Back Stamp Duty on Second Homes

You paid the additional five percent surcharge when purchasing your new home because you temporarily owned two properties. If you sell your previous main residence within three years (36 months) of completing on the new property, HMRC refunds the surcharge portion. This applies only when both properties served as your main residence, not investment properties.

Main residence definition matters enormously here. HMRC considers where you actually live, receive mail, register for council tax, and spend most nights. Holiday homes that become permanent residences qualify differently than properties that were always intended as main homes.

Important: Properties under £40,000 are exempt from the additional dwelling surcharge entirely, so no refund applies in these cases.

Divorce & Separation: Reclaiming Your Stamp Duty Surcharge

Relationship breakdowns create unique stamp duty complications. When couples separate, one partner often retains the family home while the other purchases elsewhere. Despite living separately, you might technically own a share in your ex-partner’s property, triggering the surcharge when buying your new home.

You can claim back stamp duty once you formally relinquish ownership of the shared property through divorce proceedings or sale. The three-year window runs from your new purchase completion date, giving separated couples time to finalise property settlements without losing refund eligibility.

Buy-to-Let Stamp Duty Refunds: When You Can Reclaim

Purchasing a buy-to-let property triggers the surcharge automatically. Plans change, though. Perhaps you decided making the property your home made more financial sense than renting it out. Maybe circumstances forced an unexpected move into what was intended as an investment.

If you move into the buy-to-let property as your main residence and sell your previous home within three years, you qualify to reclaim stamp duty. Documentation proving the change—utility bills, council tax records, electoral roll registration—supports your claim significantly.

Shared Ownership Adjustments

First-time buyers purchasing through shared ownership schemes faced confusing rules before November 2017. Changes introduced then mean many buyers paid incorrect amounts based on outdated calculations. If you purchased shared ownership property as a first-time buyer after this date, review your payment carefully against current guidelines.

Properties sold as shared ownership but where you later staircased to full ownership create another scenario to reclaim stamp duty. The transition from part to full ownership sometimes results in recalculations that favour the buyer.

Annexe Properties and Multiple Dwellings Relief Changes

Pre-2018 rules treated properties with separate annexes or granny flats as multiple dwellings for stamp duty purposes. This meant higher bills for buyers of single homes that happened to include self-contained living spaces. Rule revisions in 2018 recognised these as single residential properties, creating opportunities to claim back stamp duty.

Important Update: Multiple Dwellings Relief (MDR) was abolished on June 1, 2024 and can no longer be claimed for purchases after this date. However, if you purchased a property with an annexe before MDR’s abolition and paid based on multiple dwelling calculations, you might reclaim the difference. The property must genuinely serve as one home despite the separate living area.

Partner’s Existing Property

Couples often face this scenario when moving in together. One partner owns property already, triggering the surcharge when the couple buys their shared home together. If the partner with existing property sells it within three years of the new purchase, you can claim back the stamp duty surcharge.

Marriage doesn’t automatically merge property ownership for stamp duty purposes. The partner who didn’t own property previously still qualifies for first-time buyer relief in certain circumstances, while the couple might reclaim surcharges based on selling the pre-existing property.

Non-UK Residents: Reclaiming the 2% Surcharge

Non-UK residents face an additional 2% surcharge on top of all other rates when purchasing residential property. However, if you become a UK resident (present in the UK for at least 183 days within a 365-day period, either 364 days before or 365 days after the effective date of the transaction), you can claim back this 2% surcharge.

You must apply for this HMRC stamp duty refund within two years of the transaction’s effective date.

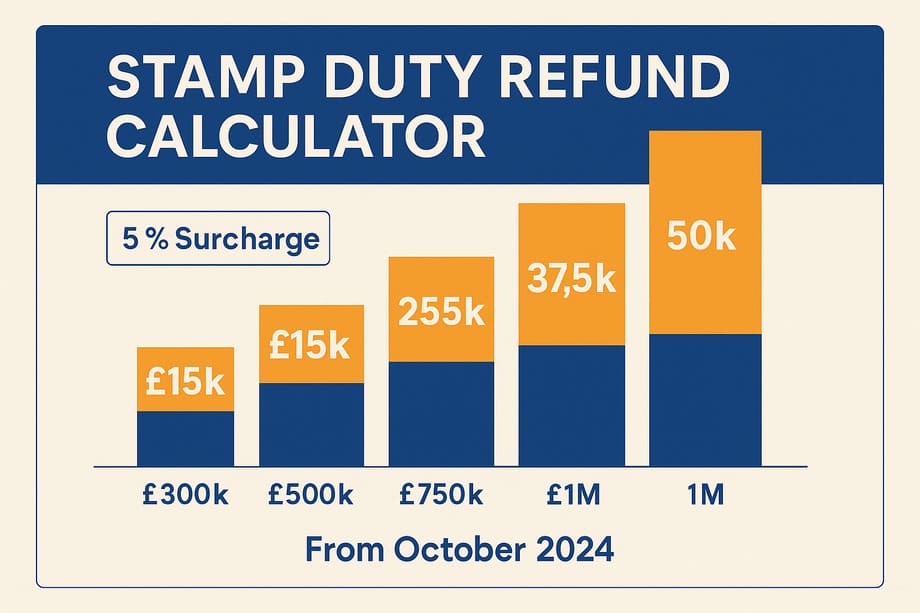

Stamp Duty Refund Calculator: How Much Can You Claim Back?

The refund covers only the five percent additional property surcharge (or 3% if you purchased before October 31, 2024), not standard stamp duty rates. Understanding exactly what you paid versus what you’ll receive back prevents disappointment and helps determine whether pursuing the claim makes financial sense.

Standard rates apply across purchase price bands. For properties over £250,000, you pay five percent on the portion between £250,001 and £925,000. The additional dwelling surcharge adds five percent across all bands where you owe duty.

Stamp Duty Refund Calculator – Current Rates (From October 31, 2024)

Use this stamp duty refund calculator guide to estimate your potential refund:

| Property Value | Standard SDLT | With 5% Surcharge | Refundable Amount |

|---|---|---|---|

| £250,000 | £0 | £12,500 | £12,500 |

| £300,000 | £2,500 | £17,500 | £15,000 |

| £400,000 | £5,000 | £25,000 | £20,000 |

| £500,000 | £12,500 | £37,500 | £25,000 |

| £600,000 | £17,500 | £47,500 | £30,000 |

| £750,000 | £25,000 | £62,500 | £37,500 |

| £1,000,000 | £40,000 | £90,000 | £50,000 |

| £1,500,000 | £90,000 | £165,000 | £75,000 |

Example Calculation:

A £500,000 property purchase normally costs £12,500 in stamp duty for a sole residence buyer. With the additional property surcharge applied, the total reaches £37,500. The difference—£25,000—represents your potential refund if you sell your previous main residence within the qualifying period.

Higher value properties generate larger refunds proportionally. A £750,000 purchase that incurred the surcharge costs £62,500 in total stamp duty versus £25,000 without it. Selling your previous home recovers that £37,500 surcharge portion.

Historical Rates: Purchases Before October 31, 2024

If you purchased your property between April 2016 and October 30, 2024, the additional dwelling surcharge was 3% instead of 5%. Use this calculator for historical purchases:

| Property Value | Standard SDLT | With 3% Surcharge | Refundable Amount |

|---|---|---|---|

| £250,000 | £0 | £7,500 | £7,500 |

| £300,000 | £2,500 | £11,500 | £9,000 |

| £400,000 | £5,000 | £17,000 | £12,000 |

| £500,000 | £12,500 | £27,500 | £15,000 |

| £600,000 | £17,500 | £35,500 | £18,000 |

| £750,000 | £25,000 | £47,500 | £22,500 |

| £1,000,000 | £40,000 | £70,000 | £30,000 |

The calculation becomes more complex with mixed-use properties or situations involving corporate purchases. These scenarios benefit from professional guidance to ensure accurate refund calculations and proper claim preparation.

Consider also that you originally borrowed this surcharge money if your mortgage included stamp duty costs. Claiming back your stamp duty refund effectively reduces your loan-to-value ratio slightly, potentially allowing for beneficial mortgage restructuring or simply reducing overall debt faster.

How to Claim Back Stamp Duty: Complete HMRC Refund Process

HMRC provides two routes for claiming back stamp duty, online through their digital service or via paper forms sent by post. Both methods require identical information for your HMRC stamp duty refund application, though online processing typically completes faster.

An HMRC stamp duty refund is technically an amended SDLT return. You’re correcting your original return to reflect that you no longer own multiple dwellings and therefore shouldn’t have paid the higher rates.

Gathering Required Documentation

Before starting either process for claiming back stamp duty, collect these essential details:

Your full legal name exactly as it appeared on the original stamp duty return. Any variations create processing delays while HMRC verifies identity.

The unique transaction reference number (UTR) issued when you submitted your original stamp duty return. This fifteen-character code appears on your completion statement and any correspondence from HMRC regarding the original payment. Losing this reference complicates but doesn’t prevent claims—HMRC can trace transactions using property address and effective date.

Complete address details for both the property you purchased (which incurred the surcharge) and the previous main residence you’ve now sold. Including postcodes ensures accurate matching against HMRC records.

Exact completion dates (effective dates) for both transactions. The purchase date determines your three-year window, while the sale date proves you disposed of the previous residence within the qualifying period.

The total stamp duty paid originally, broken down between standard rates and the additional property surcharge. Your completion statement itemises these figures clearly.

The name and address of the buyer who purchased your previous property from you. HMRC may verify the sale occurred as claimed by cross-referencing their records.

Bank account details where you want the refund paid. Provide sort code and account number carefully—errors here delay payment significantly once HMRC approves your claim to reclaim stamp duty.

Using the Online Service for Your HMRC Stamp Duty Refund

Navigate to GOV.UK and search for “claim stamp duty refund” or “SDLT16” to access the digital form. You’ll need to create or log into your Government Gateway account, which provides secure access to various HMRC services.

The online form guides you through sections covering your details, property information, and refund calculation. It validates entries as you progress, catching errors before submission. This validation feature alone makes the online route preferable for most people claiming back stamp duty.

Section one requests your personal details and contact information. Accuracy matters here—HMRC uses these details for all correspondence regarding your claim to reclaim stamp duty. Providing a mobile number enables text updates about processing status.

Section two covers the property that attracted the surcharge. Enter addresses carefully, as HMRC matches these against their transaction records. The unique reference number links your claim to the original stamp duty return automatically.

Section three addresses the property you’ve sold, proving you no longer own multiple residences. Again, precise dates and addresses ensure smooth processing without queries from HMRC staff.

The final section calculates your refund based on figures you provide. Double-check these against your original completion statement under-claiming means losing money, while over-claiming triggers investigations that delay everything.

Review the completed form thoroughly before submitting. The system generates a submission reference number once you’ve sent your claim to claim back stamp duty. Save this reference securely for tracking purposes.

Paper Form Submission: Claiming Back Stamp Duty by Post

Some buyers prefer traditional paper forms or lack digital access. HMRC accepts postal applications for claiming back stamp duty using form SDLT16, available from their website or by phone request.

Complete the form using black ink and capital letters where indicated. This improves scanning accuracy when HMRC digitises your submission. Attach photocopies, never originals of supporting documents like completion statements and sale contracts.

Send the completed SDLT16 form to the address printed on it, which varies depending on whether you’re reclaiming stamp duty from England or Northern Ireland. Use recorded delivery to confirm arrival and protect against postal delays or loss.

Processing times for paper applications typically extend several days longer than online submissions due to manual handling and data entry requirements. However, HMRC treats both submission methods equally once processing begins.

What Happens After Submitting Your Claim to Reclaim Stamp Duty

HMRC acknowledges receipt of online submissions immediately through your Government Gateway account. Paper submissions generate written acknowledgment within five working days, assuming HMRC considers the application complete.

The assessment phase involves HMRC staff verifying the information you provided against their transaction records and confirming you meet eligibility criteria for claiming back stamp duty. This verification includes checking completion dates fall within the three-year window and confirming the property sold was genuinely your previous main residence.

Most straightforward claims to reclaim stamp duty process within fifteen working days of submission. Complex cases involving unusual property types, corporate ownership, or missing information take longer, typically 30 to 90 days. HMRC contacts you if they require additional evidence or clarification.

Approved HMRC stamp duty refunds transfer directly to the bank account specified on your claim form. The payment appears as “HMRC SDLT” on your statement. Rejected claims receive written explanation of the rejection reasons and information about appeal rights.

Common Reasons HMRC Stamp Duty Refund Claims Get Rejected (And How to Fix Them)

Understanding why applications to claim back stamp duty fail helps you avoid these pitfalls and strengthens your submission from the start.

Missing the Deadline

The twelve-month window for claiming back stamp duty runs from the latest of two dates—either twelve months after filing your stamp duty return for the new property, or twelve months after selling the previous property. Many buyers assume the clock starts from purchase completion rather than return filing, causing missed deadlines.

Filing your stamp duty return happens within fourteen days of completion by law, but actual filing dates vary. Check your records carefully to establish the exact date HMRC received your return, then calculate forward twelve months. This represents your absolute deadline for submitting claims to reclaim stamp duty.

Late claims receive automatic rejection with no discretion for circumstances. HMRC enforces this deadline strictly because it helps them manage cash flow and prevents indefinite liability for refunds. Missing it by even a single day costs you the entire refund.

Insufficient Evidence of Main Residence

HMRC frequently challenges whether properties genuinely served as main residences rather than investment properties or second homes. Your claim to claim back stamp duty must demonstrate both properties functioned as your primary home at relevant times.

Supporting evidence includes council tax bills addressed to you at both properties, utility accounts in your name, correspondence from banks or government departments sent to the addresses, and electoral roll registration. The more documentation you provide, the harder it becomes for HMRC to dispute main residence status.

Properties left empty for extended periods or furnished as holiday homes face particular scrutiny. If you struggled to sell your previous home and it sat vacant for months, gather evidence showing you intended to return if the sale fell through and treated it as your home throughout this period.

Incorrect Calculations

Claiming the wrong amount when trying to reclaim stamp duty triggers queries and delays even when you genuinely qualify for a refund. HMRC calculates refunds based on the exact five percent surcharge you paid (or 3% for purchases before October 31, 2024), which varies depending on purchase price and applicable rates at the time.

Review your original completion statement to identify the surcharge component precisely. If you cannot locate this document, your conveyancer retains copies and must provide them on request. Never estimate refund amounts based on rough calculations—accuracy matters enormously in HMRC’s assessment of your claim to claim back stamp duty.

Properties purchased at prices near rate band thresholds require particularly careful calculation. Small differences in purchase price can significantly affect which rates applied and therefore the surcharge you paid.

Partnership or Corporate Ownership Issues

Purchases made through limited companies, partnerships, or trusts face different stamp duty rules and refund eligibility criteria when claiming back stamp duty. HMRC treats these transactions distinctly from individual purchases, and many buyers incorrectly assume standard refund rules apply.

If you purchased through a corporate structure for tax planning or investment purposes, seek specialist advice before attempting to reclaim stamp duty. The rules governing these situations contain numerous technical requirements that non-specialists easily overlook.

Maximising Your Success When Claiming Back Stamp Duty

Several strategies improve your chances of smooth claim processing and prompt payment when you reclaim stamp duty.

Keep Meticulous Records

From the moment you complete on any property purchase, retain every document relating to the transaction. This includes contracts, completion statements, mortgage offers, stamp duty returns, and correspondence with your conveyancer.

Create a dedicated file—physical or digital—for each property you own. When the time comes to claim back your stamp duty refund, having organised records transforms a potentially stressful process into a straightforward administrative task.

Photograph or scan important documents to create backups. Fire, flood, or simple misplacement can destroy paperwork you’ll desperately need later when claiming back stamp duty. Cloud storage provides secure, accessible backup that survives even catastrophic loss of physical documents.

Submit Claims to Reclaim Stamp Duty Promptly

While you have twelve months to claim back stamp duty, submitting earlier rather than later offers several advantages. HMRC processes claims in the order received, and later submissions may encounter seasonal backlogs during busy periods.

Early submission also provides more time to address any queries HMRC raises about your claim to reclaim stamp duty. If they request additional information, you’ll have breathing room to provide it without rushing against your deadline. This reduces stress and allows thorough responses that satisfy HMRC requirements first time.

The financial benefit matters too. HMRC stamp duty refunds approved quickly put money back in your account sooner, where it can offset mortgage costs, fund home improvements, or simply provide financial breathing room after the expense of moving.

Consider Professional Assistance for Complex Cases

Most straightforward claims to reclaim stamp duty require no professional help—HMRC designs the process for direct public access. However, certain situations benefit from expert guidance.

Multiple property portfolios, corporate purchases, properties held in trust, mixed-use properties, or situations involving inheritance all introduce complications that non-specialists struggle to navigate. Conveyancing solicitors or tax advisers specialising in stamp duty handle these cases routinely and understand exactly what HMRC requires for claiming back stamp duty.

Professional fees typically represent a small percentage of potential refunds on high-value properties. Weigh the cost against the refund amount and complexity of your situation. For a £30,000 refund on a complex case, paying £500 for professional preparation and submission might prove worthwhile insurance against rejection.

Avoid Claim Management Companies

Companies advertising no-win, no-fee stamp duty refund services regularly cold-call homeowners or advertise online. These businesses charge substantial fees—often twenty to thirty percent of refunds—for services you can easily handle yourself when claiming back stamp duty.

HMRC provides clear, accessible guidance on their website alongside simple online forms. The process requires no specialist knowledge for standard cases. Paying someone to complete a form you could manage alone makes little financial sense.

Some claim management companies misrepresent themselves as official bodies or create urgency suggesting deadlines that don’t exist. If you receive unsolicited contact about claiming back stamp duty, ignore it completely. Only work with established professional advisers you’ve chosen yourself if you decide professional help suits your circumstances.

What to Do If HMRC Rejects Your Claim to Reclaim Stamp Duty

Rejection doesn’t necessarily end your hopes to claim back stamp duty. Understanding appeal rights and processes gives you options even after initial refusal.

Understanding Rejection Letters

HMRC explains rejection reasons in writing, usually within four weeks of receiving your claim to reclaim stamp duty. Read this letter carefully—it details specific issues preventing approval and may suggest remedies.

Common rejection reasons include missing information, insufficient evidence of main residence status, or determination that you don’t meet eligibility criteria. Some rejections indicate technical errors you can correct through resubmission rather than formal appeals.

If the rejection stems from missing documents or incomplete information, gather what HMRC requires and resubmit. The original submission date may still count for deadline purposes if you respond promptly to HMRC’s request for additional information.

Formal Appeal Process

Disagreeing with HMRC’s assessment entitles you to formal appeal when claiming back stamp duty. You must appeal within thirty days of the rejection date—this deadline applies strictly, so act quickly if you believe HMRC erred.

Submit appeals through HMRC’s online dispute service or by post. Clearly explain why you believe the rejection was incorrect, providing any additional evidence supporting your position. Focus on factual matters—demonstrating dates, proving residence status, or showing calculation errors HMRC made.

HMRC reviews appeals independently from the original decision maker. They may request additional information or arrange phone discussions to clarify disputed points. This review typically completes within forty-five days, though complex cases take longer.

If HMRC maintains their rejection after review, you can escalate to the Tax Tribunal—an independent body that adjudicates disputes between taxpayers and HMRC. This route suits only significant refunds and situations where you have strong evidence HMRC applied rules incorrectly.

Learning from Rejection

Sometimes rejection reveals genuine ineligibility you hadn’t recognised. Perhaps your previous property genuinely didn’t qualify as your main residence, or you misunderstood the three-year requirement.

Accept rejection gracefully when evidence clearly shows you don’t meet criteria for claiming back stamp duty. Pursuing hopeless appeals wastes time and risks HMRC scrutiny of your wider tax affairs. Focus instead on lessons learned and ensuring future property transactions account for stamp duty implications from the start.

Planning Future Purchases to Avoid Surcharges

Understanding how to claim back stamp duty helps with future property transactions too. Smart planning minimises surcharge exposure and simplifies ownership structures.

Timing Property Transactions

Coordinating purchases and sales to avoid temporary dual ownership eliminates surcharge liability entirely. Easier said than done in reality—chains collapse, perfect properties appear at inconvenient moments, and rental arrangements expire according to their own schedules.

When timing coordination proves possible, aim to complete sales before purchasing. This clearly establishes you as a single property owner when buying your next home. Even a few days’ gap between completion dates saves the entire surcharge and eliminates the need to claim back stamp duty later.

Building flexibility into moving timelines helps achieve beneficial timing. Short-term rentals, extended stays with family, or delayed completion dates—when sellers and buyers both agree—create space for selling your current property before completing on the next.

Considering Joint Ownership Arrangements

Couples where one partner owns property already face surcharge implications when buying together. Creative ownership structures sometimes avoid or reduce these charges, though HMRC scrutinises arrangements designed primarily for tax avoidance.

If one partner qualifies as a first-time buyer, purchasing solely in their name preserves their relief and avoids surcharges that would apply to joint ownership. This strategy works only when the first-time buyer has sufficient income to support mortgage applications alone and both partners accept the legal implications of single-name ownership.

Professional legal and tax advice becomes essential when considering ownership structures driven by stamp duty considerations. Rules surrounding beneficial ownership, inheritance rights, and mortgage eligibility create complexities that require expert navigation.

Understanding Your Three-Year Window to Claim Back Stamp Duty

Knowing you have three years to sell previous properties without losing the ability to claim back stamp duty provides valuable flexibility. You needn’t rush sales or accept poor offers simply to beat stamp duty deadlines, the three-year window gives reasonable time to achieve good sale prices.

This extended period accommodates difficult markets, problematic properties, or personal circumstances that complicate immediate sales. Inherited properties requiring extensive repairs before selling, homes in depressed markets, or situations where care considerations for elderly relatives delay sales all fall within this protection.

Mark your calendar with the three-year anniversary of completing on any property that triggered surcharges. This reminder ensures you don’t inadvertently waste your opportunity to claim back stamp duty by letting the window close without acting.

Frequently Asked Questions About Claiming Back Stamp Duty

Can I claim back stamp duty if I bought my property five years ago?

Claims to reclaim stamp duty must be submitted within twelve months of either your stamp duty return filing date or the date you sold your previous main residence, whichever is later. If both these dates occurred more than twelve months ago, you’ve missed the claiming deadline unfortunately. HMRC enforces this timeframe strictly with no extensions for any circumstances.

How much stamp duty can I claim back?

Refunds cover only the five percent additional property surcharge (or 3% for purchases before October 31, 2024), not standard stamp duty rates. On a £500,000 property purchased after October 31, 2024, the surcharge totals £25,000, this represents the refundable amount when you claim back stamp duty. Standard rate duty of £12,500 remains non-refundable even when you qualify for the surcharge refund.

Do I need a solicitor to claim back my stamp duty refund?

No, HMRC designs the claim process for direct public use without professional assistance. The online form guides you through required information step-by-step. Solicitors help only when complex ownership structures, corporate purchases, or unusual property types create complications beyond straightforward main residence replacements.

What happens if I sell my property for less than I paid?

Sale prices don’t affect refund eligibility or amounts when claiming back stamp duty. The surcharge calculation depends on your purchase price for the new property, not eventual sale prices for either property. Selling at a loss doesn’t reduce or eliminate your refund, the five percent you paid on purchase remains reclaimable regardless of later sale proceeds.

Can I claim back stamp duty if my partner owns another property?

Yes, if you jointly purchase a new home together and then sell your partner’s previous property within three years of the new purchase completing. The surcharge applies because your household owns multiple properties, and you can reclaim stamp duty when returning to single property ownership. Both partners needn’t have owned properties previously for the surcharge to have applied.

How long does HMRC take to process claims to reclaim stamp duty?

Straightforward HMRC stamp duty refund claims typically complete within fifteen working days from submission. Complex cases involving verification requirements, corporate structures, or unusual property types may take between thirty to ninety days. HMRC prioritises claims in receipt order, so earlier submission generally means faster processing.

What if HMRC owes me more than I claimed?

HMRC calculates refunds based on your submission when claiming back stamp duty. If you under-claim through calculation errors, they pay only what you requested. They don’t spontaneously identify and pay higher amounts you should have claimed. This makes accurate calculation using original completion statements essential check figures carefully before submitting.

Can I claim back stamp duty for properties I bought jointly with someone who wasn’t my spouse?

Yes, refund rules apply to any joint purchase regardless of relationship between buyers. Unmarried couples, siblings, friends, or business partners buying residential property jointly all face identical surcharge rules and refund eligibility when claiming back stamp duty. The main residence requirement for both properties must be met regardless of relationships involved.

What evidence do I need to prove main residence status?

Council tax bills, utility accounts, bank statements, and electoral roll registration all demonstrate residence status. The more documentation you provide showing the property as your primary home, the stronger your position when claiming back stamp duty. HMRC looks for consistent, contemporaneous evidence rather than documents created specifically for refund claims.

Do I pay tax on stamp duty refunds when I reclaim stamp duty?

No, refunds simply return tax you overpaid rather than representing income. HMRC transfers the money directly to your bank account without any tax deducted. You needn’t declare HMRC stamp duty refunds on tax returns or self-assessment forms.

Can first-time buyers claim back stamp duty?

First-time buyer relief prevents surcharges applying to qualifying purchases, making refunds largely irrelevant. However, if you paid surcharges incorrectly due to HMRC errors or received inaccurate advice, you might reclaim amounts you shouldn’t have paid. Review your original calculations carefully against current first-time buyer thresholds.

What happens if I bought using a limited company?

Corporate purchases follow different stamp duty rules with higher rates and different refund criteria. Companies cannot claim main residence status, eliminating most common scenarios to claim back stamp duty. Some corporate ownership situations permit relief, but these require specialist tax advice to navigate correctly.

How do I claim back the 2% non-resident surcharge?

If you paid the 2% non-resident surcharge but subsequently became a UK resident (present for 183 days within a 365-day period around the transaction), you can reclaim this surcharge. Apply within two years of the effective date using HMRC’s standard refund process, providing evidence of your UK residency.

What if I had exceptional circumstances preventing me from selling within 3 years?

HMRC recognises some exceptional circumstances beyond your control that prevented selling your previous home within three years. Examples include COVID-19 restrictions or actions by public authorities. Write to HMRC explaining the circumstances with supporting evidence. Normal events like not finding a buyer at your desired price don’t count as exceptional.

Can I use a stamp duty refund calculator to check my eligibility?

Use the stamp duty refund calculator tables in this guide to estimate your potential refund amount. However, calculators only show amounts they don’t determine eligibility. You must meet the main residence replacement criteria and sell within the three-year window to claim back stamp duty, regardless of the refund amount.

What is the effective date for stamp duty purposes?

The effective date is usually your completion date when ownership legally transfers and you receive keys. This date determines when your three-year window begins and which rates apply to your purchase. For HMRC stamp duty refund purposes, you calculate all deadlines from this effective date.

What is an amended return when claiming back stamp duty?

When you claim back stamp duty, you’re technically submitting an amended SDLT return. This corrects your original return to reflect that you no longer own multiple dwellings and shouldn’t have paid the higher rates for additional dwellings (HRAD). The SDLT16 form is the standard form for these amended returns.

How does claiming back stamp duty affect my mortgage?

Reclaiming stamp duty doesn’t directly affect your mortgage terms. However, if you originally borrowed money to pay the stamp duty, receiving a refund means you’ve effectively overpaid your purchase costs. Some buyers use refunds to make mortgage overpayments or reduce other debts.

What’s the difference between claiming back stamp duty and getting a refund on miscalculated duty?

Both scenarios allow you to reclaim stamp duty, but for different reasons. Main residence replacement refunds apply when you correctly paid the surcharge but later qualified for a refund by selling your old home. Miscalculation refunds apply when the wrong rate was applied from the start, such as paying residential rates on uninhabitable property that should have used non-residential rates.

Can I claim back stamp duty on properties outside England and Northern Ireland?

SDLT only applies to properties in England and Northern Ireland. Scotland uses Land and Buildings Transaction Tax (LBTT) and Wales uses Land Transaction Tax (LTT). These have similar refund provisions but different processes. This guide covers HMRC stamp duty refunds for England and Northern Ireland only.

Taking Action on Claiming Back Your Stamp Duty

Thousands of pounds might be waiting in unclaimed refunds simply because homeowners don’t realise they can claim back stamp duty. The combination of clear eligibility rules, straightforward claim processes, and generous three-year windows means most qualifying buyers can successfully reclaim surcharges they shouldn’t ultimately have paid.

Review your property purchase history against the criteria explained here. If you replaced your main residence within three years of a purchase that incurred surcharges, you almost certainly qualify to claim back stamp duty. Even if several years have passed since your purchase, you might still fall within the twelve-month claiming window if you only recently sold your previous home.

Gathering documentation and completing claim forms takes a few hours at most for straightforward cases. The potential return—often £15,000 to £37,500 or more—makes this time investment worthwhile by any measure when claiming back stamp duty. HMRC won’t spontaneously refund money they’ve collected legitimately according to circumstances at the time. You must identify your eligibility and claim actively.

Don’t let companies charging excessive fees claim your refund for you. The process genuinely suits self-completion in most circumstances for claiming back stamp duty. Save those fees for yourselves rather than enriching claim management firms providing minimal value.

If you’re planning future property purchases, understanding these rules helps structure transactions to minimise surcharges from the outset. While you can’t always avoid temporary dual ownership, knowing the implications helps you plan financially and set realistic expectations for funds you’ll ultimately reclaim.

Start today by locating your completion statements and stamp duty returns. Check dates against the twelve-month deadline for your situation. If you’re within the window and meet eligibility criteria, HMRC’s online service awaits. Fifteen minutes completing a form could help you reclaim stamp duty worth thousands of pounds you never thought you’d see again.

Summary: Your Checklist for Claiming Back Stamp Duty

Quick Eligibility Check

Use this checklist to determine if you can claim back stamp duty:

- I bought a new main residence before selling my previous main residence

- I paid the 5% additional dwelling surcharge (or 3% if before October 31, 2024)

- I sold my previous main residence within 36 months of buying the new property

- Both properties were genuinely my main residences (not investment properties)

- It’s been less than 12 months since I sold my previous home OR less than 12 months since I filed my SDLT return for the new property (whichever is later)

If you ticked all boxes, you likely qualify to claim back your stamp duty surcharge!

Current Rates Summary (October 2024 Onwards)

Additional Dwelling Surcharge: 5% on all rate bands Non-Resident Surcharge: Additional 2% for non-UK residents Exemption Threshold: Properties under £40,000

Key Deadlines for Claiming Back Stamp Duty

| Action | Deadline |

|---|---|

| Sell previous main residence | Within 36 months (3 years) of buying new property |

| Submit refund claim | Within 12 months of sale OR 12 months of SDLT return filing date (whichever is later) |

| Appeal rejection | Within 30 days of rejection letter |

| Non-resident refund claim | Within 24 months (2 years) of effective date |

What You Can Reclaim: Stamp Duty Refund Calculator Quick Reference

For purchases from October 31, 2024 onwards (5% surcharge):

- £300,000 property = £15,000 refund

- £400,000 property = £20,000 refund

- £500,000 property = £25,000 refund

- £600,000 property = £30,000 refund

- £750,000 property = £37,500 refund

- £1,000,000 property = £50,000 refund

For purchases before October 31, 2024 (3% surcharge):

- £300,000 property = £9,000 refund

- £400,000 property = £12,000 refund

- £500,000 property = £15,000 refund

- £600,000 property = £18,000 refund

- £750,000 property = £22,500 refund

- £1,000,000 property = £30,000 refund

Documents Needed to Claim Back Stamp Duty

Essential:

- Original SDLT return (with unique transaction reference number)

- Completion statement for new property purchase

- Completion statement or evidence of previous property sale

- Bank account details for refund payment

Supporting Evidence:

- Council tax bills for both properties

- Utility bills showing your name at both addresses

- Electoral roll registration

- Correspondence showing both as main residences

How to Submit Your Claim to Reclaim Stamp Duty

Option 1: Online (Recommended)

- Visit GOV.UK and search “SDLT16” or “claim stamp duty refund”

- Sign in with Government Gateway credentials (or create account)

- Complete form online with all required information

- Submit and save your reference number

- Typical processing: 15 working days

Option 2: Paper Form

- Download form SDLT16 from GOV.UK

- Complete in black ink using capital letters

- Attach photocopies (not originals) of supporting documents

- Send by recorded delivery to address on form

- Typical processing: 15-30 working days

Common Mistakes When Claiming Back Stamp Duty (Avoid These!)

- Missing the 12-month deadline – Check your dates carefully

- Calculating wrong refund amount – Use your original completion statement

- Insufficient main residence evidence – Provide multiple proof documents

- Using claim management companies – You can do this yourself easily

- Not keeping copies – Save all documents and your submission reference

- Forgetting the 3-year rule – You must have sold within 36 months of purchase

HMRC Stamp Duty Refund Processing Times

| Scenario | Typical Processing Time |

|---|---|

| Straightforward online claim | 15 working days |

| Complex cases requiring verification | 30-60 working days |

| Cases with missing information | 60-90 working days |

| Paper form submissions | 20-45 working days |

| Appeals against rejection | 45-90 working days |

Next Steps: Start Claiming Back Your Stamp Duty Today

Step 1: Check your eligibility using the checklist above

Step 2: Calculate your potential refund using our stamp duty refund calculator tables

Step 3: Gather all required documents and evidence

Step 4: Submit your claim online at GOV.UK or by post using form SDLT16

Step 5: Track your claim using your reference number

Step 6: Receive your refund directly into your bank account

Regional Variations

This guide covers: England and Northern Ireland (SDLT)

Scotland uses: Land and Buildings Transaction Tax (LBTT) – different rules and forms apply

Wales uses: Land Transaction Tax (LTT) – different rules and forms apply

For Scottish or Welsh properties, contact Revenue Scotland or Welsh Revenue Authority respectively for guidance on claiming back your property tax surcharge.

Important Reminders About Claiming Back Stamp Duty

- Rate Change: The surcharge increased from 3% to 5% on October 31, 2024. Check which rate applied to your purchase.

- MDR Abolished: Multiple Dwellings Relief was abolished on June 1, 2024 and cannot be claimed for purchases after this date.

- Deadlines Are Strict: HMRC does not grant extensions to the 12-month claiming deadline under any circumstances.

- Main Residence Must Be Genuine: HMRC will check council tax, utilities, and other records to verify both properties were truly your main homes.

- Non-Residents Have Different Rules: The 2% non-resident surcharge has a separate 2-year claiming deadline.

When to Seek Professional Help

Most people can successfully claim back stamp duty without professional assistance. However, consider consulting a specialist if:

- You purchased through a limited company or trust

- The property is mixed-use (part residential, part commercial)

- You own multiple properties with complex ownership structures

- Your case involves inheritance or partnership arrangements

- HMRC has rejected your claim and you want to appeal

- The potential refund exceeds £50,000

Professional fees for complex cases typically range from £500-£1,500 but can be worthwhile for large refunds or complicated situations.

Staying Updated

Stamp duty rules and rates change periodically through government budgets. Always check the current rates and rules at GOV.UK before claiming back stamp duty, especially if several years have passed since your property purchase.

Subscribe to HMRC updates or consult with property tax specialists if you’re planning future purchases to ensure you understand current rules and can structure transactions optimally.

Final Word: Don’t Leave Money on the Table

Millions of pounds in unclaimed HMRC stamp duty refunds sit waiting for homeowners who simply don’t know they can claim back stamp duty. If you’ve ever owned two properties simultaneously even briefly, you may be entitled to reclaim thousands of pounds.

The process is straightforward for most people, requiring only a few hours to gather documents and complete the online form. With potential refunds ranging from £15,000 to £50,000 or more, those few hours represent an excellent return on your time investment.

Don’t assume you don’t qualify. Check your circumstances against this guide. Calculate your potential refund using our stamp duty refund calculator. If you meet the criteria and you’re within the deadlines, claiming back your stamp duty could put a substantial sum back in your pocket.

Start your claim to reclaim stamp duty today, the money is rightfully yours.

This guide provides general information about claiming back stamp duty based on current HMRC rules and regulations. Property transactions involve complex legal and financial considerations unique to individual circumstances. While the information presented aims for accuracy, it should not substitute for professional legal or tax advice tailored to your specific situation. Always verify current rules directly with HMRC or qualified advisers before making property decisions or submitting refund claims. Last updated: October 2025.

Last Updated on October 15, 2025 by James Cartwright